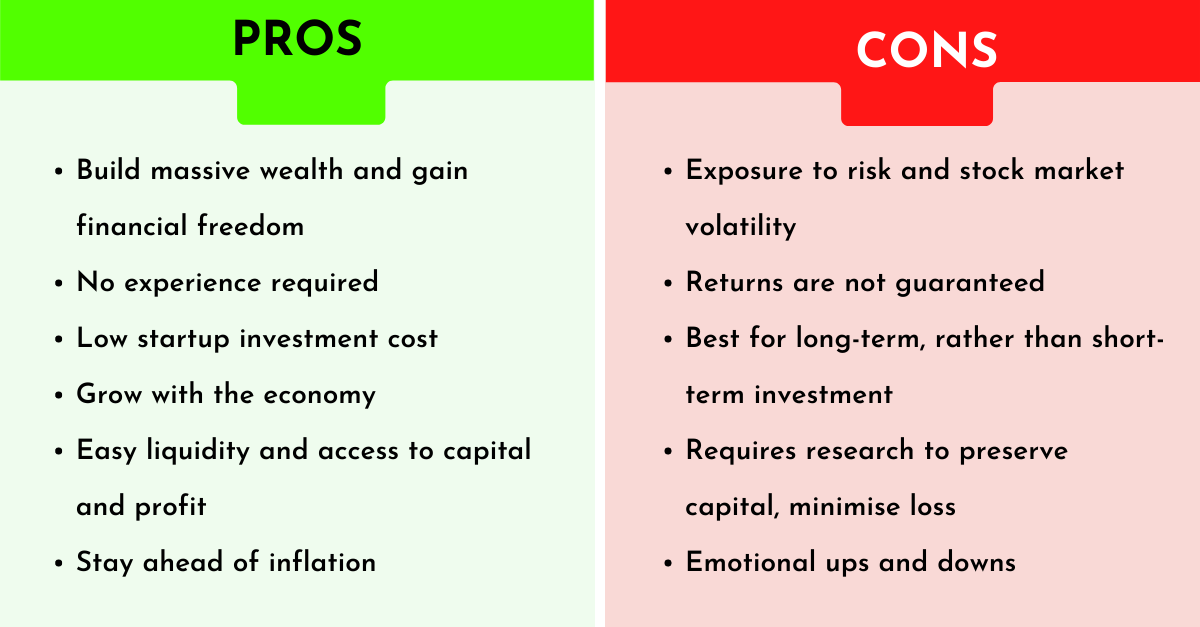

Pros of the stock market include potential for high returns and liquidity; cons involve market volatility and the risk of significant losses. The stock market offers opportunities for wealth creation through strategic investment in shares of public companies.

Engaging in the stock market can lead to substantial financial growth for informed investors who understand market trends and company performance. With the ability to quickly buy and sell stocks, investors enjoy a high level of liquidity, making it possible to react swiftly to market changes.

On the flip side, stock market investments carry inherent risks, as stock prices are susceptible to sudden fluctuations due to economic shifts, global events, or company-specific news. Investors must be prepared for the possibility of losing their initial capital, especially if they engage in speculative trading without adequate research or risk management strategies. Navigating the stock market’s complexities requires diligence, continuous learning, and a balanced approach to investing.

Table of Contents

Introduction To Stock Market Investing

Introduction to Stock Market Investing starts with understanding the playground of shares. The stock market is where people buy and sell company stocks. It’s like a big shop for investments. You can own a part of a company by buying its stock. If the company does well, so do you. But if it doesn’t, you may lose money.

Attractions Of The Stock Market

- Ownership: Buying shares means owning a piece of a company.

- Profit Potential: Stocks can grow in value and pay dividends.

- Liquidity: It’s easy to buy and sell stocks quickly.

- Diversity: Many types of stocks are available.

Risks Associated With Equities

- Market Volatility: Prices of stocks go up and down fast.

- No Guarantees: You can lose your investment.

- Emotional Decisions: Fear and greed can harm your choices.

- Timing: Buying or selling at the wrong time can mean losses.

Pros: Wealth Building Opportunities

Exploring the stock market reveals exciting wealth building paths. Smart investments can grow savings. They also provide extra income through dividends. Let’s look at the top benefits.

Long-term Growth Potential

Stocks offer impressive long-term growth. Historically, markets rise in value. This trend favors patient investors. Diversified portfolios typically see steady gains over years. With time, even small investments can become significant.

Dividend Income Benefits

Some stocks pay dividends. This means regular income for shareholders. It’s like getting a pay-check from your investments. This income can be reinvested or used as passive income. Over time, dividend-paying stocks can provide a stable financial base.

| Pros | Details |

|---|---|

| Long-term Growth | Stocks have the potential to increase in value, resulting in significant returns for investors who are patient and invest wisely. |

| Dividend Income | Investors can earn regular income from dividends, which can be used to reinvest or as a source of passive income. |

Pros: Economic Participation

Investing in the stock market allows individuals to be part of the economy. People can support companies they believe in. They can also help new ideas grow. This is a big plus of the stock market.

Supporting Businesses And Innovation

When you buy stocks, you give money to businesses. This money helps them create new products and services. Investors play a key role in driving innovation. Here’s how they contribute:

- Funding – Money from stocks helps companies grow.

- Job Creation – Growing companies hire more people.

- Economic Growth – Successful companies boost the economy.

Shareholder Voting Rights

Stock owners get to vote on important company decisions. Voting rights empower investors to influence a company’s future. They can vote on things like:

- Choosing the board of directors.

- Approving mergers or acquisitions.

- Decisions on company policies.

This means your voice counts. You can help shape the business you invest in.

Pros: Liquidity And Flexibility

Liquidity and flexibility stand out as major advantages in the stock market. They allow investors to respond swiftly to market changes. This section highlights how these benefits can play a significant role in an investor’s strategy.

Ease Of Buying And Selling

The stock market’s high liquidity means investors can quickly enter or exit positions. With just a few clicks, stocks can be bought or sold during trading hours. This ease of transaction is attractive for those seeking to capitalize on market opportunities or those who may need to liquidate assets.

Diverse Investment Options

Stock market flexibility is evident in the wide array of investment choices. Investors can choose from large-cap stocks, small-cap stocks, international stocks, sector-specific stocks, and even Exchange-Traded Funds (ETFs). This variety allows for tailored investment strategies to fit individual goals and risk tolerances.

- Large-cap stocks: Known for stability and consistent dividends.

- Small-cap stocks: Potential for significant growth, higher risk.

- International stocks: Access to foreign markets, currency diversity.

- Sector-specific stocks: Focus on specific industry growth.

- ETFs: Diversification with a single transaction.

Cons: Market Volatility

The stock market is like a roller coaster. It goes up and down often. This change is called market volatility. Sometimes, it can be scary. Let’s talk about some tricky parts of this ride.

Short-term Price Fluctuations

Stock prices change every second. This can be good or bad. In the short term, these changes can be very big. It’s hard to guess what will happen next. This can make it tough to know when to buy or sell.

- Unexpected news can make prices go up or down fast.

- Even rumors can affect stock prices.

- People who need money soon may not like this risk.

Emotional Investing Pitfalls

Feelings can trick us when we invest. When stocks go down, people might panic. They may sell when prices are low. This can lead to losing money. It’s important to think carefully before making a move.

| Emotion | Impact on Investing |

|---|---|

| Fear | Selling too early |

| Greed | Buying too much |

| Hope | Holding a losing stock |

Credit: www.facebook.com

Cons: Risk Of Significant Loss

Investing in the stock market is not always a smooth ride. Risks come with the potential for rewards. One of the major downsides is the risk of losing money. This section explores the cons related to the potential financial losses that investors face.

No Guaranteed Returns

Stock market investments do not guarantee profits. Unlike a savings account, the return on investment can vary widely. The value of stocks can fluctuate due to various factors. These include market trends, economic conditions, and company performance. Market downturns can lead to reduced portfolio value. This, in turn, can affect overall investment returns.

Possibility Of Total Investment Loss

In extreme cases, investors can lose their entire investment. This can occur if a company goes bankrupt. When this happens, stockholders are the last to get paid. If there’s nothing left, they lose their investment. Diversification can reduce this risk. Yet, it cannot eliminate it completely. Understanding and managing risk is crucial in stock market investing.

<<<< Best Stock Market to Invest in 2024 >>>

Cons: Knowledge And Time Investment

Investing in the stock market is not just about money. It also demands knowledge and time. Let’s dive into why.

Research And Continuing Education

Before you invest, you need to do your homework. This means understanding the market.

- Reading financial news

- Studying company reports

- Learning investment strategies

Education never stops. The market changes. You must keep learning.

Time Commitment For Market Monitoring

Investing requires regular market monitoring. Why? To make smart decisions.

- Check stock performances daily.

- Analyze market trends weekly.

- Adjust your investment plan as needed.

This takes time. A lot of it. Success in the stock market is not instant.

Pros And Cons In Context

Understanding the stock market’s pros and cons is crucial. It helps investors make informed decisions. This context is key to navigating the complex world of investing. Let’s dive into the details.

Risk Tolerance And Personal Finance

The stock market can be a rollercoaster. Your risk tolerance matters a lot. It’s about how much risk you can handle. Some people get scared easily. Others are more brave. Knowing this helps you pick the right investments.

Let’s talk money. Your personal finance plays a big role. Investing is not free. You need money that you can afford to lose. It’s not smart to use money needed for rent or food.

- High risk can mean high reward. But also high losses.

- Invest only spare money. Keep your needs covered first.

- Know your financial goals. This guides your investing path.

Stock Market Investing Strategies

Different strategies exist in stock market investing. Each has its pros and cons.

| Strategy | Pros | Cons |

|---|---|---|

| Long-term Investing | Lower risk, potential for steady growth | Takes time to see returns |

| Day Trading | Potential for quick profits | Very high risk, requires constant attention |

| Dividend Investing | Regular income from dividends | Not all stocks offer dividends; slower growth |

Choosing the right strategy depends on your goals and risk tolerance. Each person is different. Pick what fits you best.

Tax Implications

Understanding tax implications is crucial when investing in the stock market. Taxes can affect profits. Investors must know these rules. Let’s explore the impact of taxes on stock investments.

Capital Gains Tax

Stocks sold for profit face capital gains tax. This tax applies to profits from sold investments. The rate depends on how long you held the stock.

- Short-term: Held for less than a year, taxed as regular income.

- Long-term: Held for over a year, lower tax rates apply.

| Holding Period | Tax Rate |

|---|---|

| Short-term | Up to 37% |

| Long-term | 0%, 15%, or 20% |

Tax Benefits Of Retirement Accounts

Retirement accounts like IRAs and 401(k)s offer tax benefits. These accounts can help save on taxes. They allow investments to grow tax-free or tax-deferred.

- Traditional accounts: Pay taxes on withdrawals.

- Roth accounts: Pay taxes upfront, but withdrawals are tax-free.

:max_bytes(150000):strip_icc()/dotdash-TheBalance-what-are-stocks-3306181-Final-75b1bb359b7141d9a22cb1b706f2cf2f.jpg)

Credit: www.thebalancemoney.com

Final Thoughts

As we wrap up our journey through the stock market’s ups and downs, it’s clear that savvy investing requires a delicate balance. With knowledge in hand, let’s weigh the benefits against the potential pitfalls.

Balancing Pros And Cons

Investing in stocks can be a roller coaster of highs and lows. On one side, there’s the promise of substantial returns and portfolio growth. On the other, the risk of loss looms. Here’s a quick glance at the balance sheet:

| Pros | Cons |

|---|---|

| High return potential | Market volatility |

| Dividend income | Complex analysis required |

| Liquidity | Emotional decision-making |

Making Informed Decisions

Knowledge is power in the stock market. Investors who take the time to understand the factors that influence stock prices are better prepared. They make decisions based on data, not fear or greed. Here’s how to stay informed:

- Research market trends

- Analyze company financials

- Understand economic indicators

- Follow expert commentary

Remember, each investment choice should align with your financial goals and risk tolerance. Use resources wisely to navigate the stock market’s waves.

Credit: www.fullertonmarkets.com

Frequently Asked Questions

What Are The Benefits Of Investing In Stocks?

Investing in stocks offers the potential for high returns, dividends, and portfolio diversification.

Can Stock Investments Lead To Losses?

Yes, stock market investments carry the risk of losing money, especially in the short term due to market volatility.

How Does Stock Market Volatility Affect Investors?

Market volatility can lead to unpredictable changes in stock prices, impacting investment values and decisions.

Are Dividends Guaranteed With Stock Investments?

No, dividends are not guaranteed; they depend on the company’s performance and decisions by its board of directors.

Is Stock Market Investing Suitable For Beginners?

Yes, with research and careful strategy, beginners can start investing in the stock market, though it carries risks.

Conclusion

Navigating the stock market requires balance, as it presents both opportunities and risks. Investors can reap significant gains, but must also be prepared for potential losses. Weighing these pros and cons is crucial for making informed decisions. As you chart your financial path, consider these factors to align with your goals and risk tolerance.