The best stock market to invest in 2024 will depend on current global economic conditions and individual financial goals. Research and market trends will guide investors towards the most promising exchanges.

Choosing the best stock market for investment in 2024 requires a strategic approach, considering factors such as political stability, economic growth, and technological advancements. Investors should monitor key indicators like GDP growth rates, inflation, and interest rates, which influence market performance.

Emerging markets may offer high growth potential but come with increased risk, while established markets could provide stability and steady returns. Diversification remains a cornerstone of investment strategy, spreading risk across various sectors and regions. Technology, healthcare, and green energy sectors are showing significant promise, driven by innovation and regulatory changes. Online tools and platforms offer up-to-date analysis and insights, helping investors make informed decisions. With the right research and guidance, investors can identify the stock markets that align best with their investment objectives for 2024.

Table of Contents

Best Stock Market to Invest in 2024

Introduction to Investing in 2024 unveils a year of possibilities. Smart investors eye the landscape with optimism. With new technologies and economic trends, 2024 promises unique investment opportunities. Understanding where to invest is key. This guide explores why stock markets remain a top choice for investors looking to grow their wealth.

The Financial Landscape In 2024

The year 2024 has reshaped the financial world. Key factors include:

- Global Economic Recovery: Post-pandemic growth fuels markets.

- Technological Advancements: FinTech and AI transform investing.

- Regulatory Changes: New policies affect market dynamics.

Investors must navigate this terrain with informed decisions. Diverse portfolios reduce risk. They also maximize returns.

Why Stock Markets Still Lead Investment Options

Despite new avenues, stocks offer unmatched potential. Consider these points:

- Liquidity: Stocks convert to cash quickly.

- Growth: Equities often outperform other assets.

- Accessibility: Digital platforms make trading easy.

Stocks are ideal for both beginners and seasoned investors. They are tools for financial freedom.

Credit: www.techopedia.com

Criteria For Selecting Top Stock Markets

Investors aim to put money in strong stock markets. To pick the best, certain criteria matter. We will explore what makes a stock market stand out. This helps you decide where to invest in 2024.

Market Performance Indicators

Good stock markets show strong performance indicators. Performance indicators tell us how a market is doing. Look at these:

- Historical returns: Shows past profit.

- Volatility: Tells us about price changes.

- Trading volume: High volume means active trading.

These factors help predict future success.

Economic Stability And Growth Prospects

Stable economies often have strong stock markets. Growth prospects also matter. Look for these signs:

- GDP growth: A growing economy is good.

- Inflation rates: Low inflation suggests stability.

- Employment data: More jobs mean a stronger market.

These points suggest a healthy investment environment.

Regulatory Environment And Investor Protection

Rules in a market protect investors. Good regulation means safer investments. We want these:

- Clear laws: They should be easy to understand.

- Enforcement: Rules need action to work.

- Transparency: Investors must see clear data.

These ensure your investments are secure.

Emerging Markets To Watch

Are you ready to explore the Emerging Markets to Watch in 2024? These markets offer exciting opportunities for investors. They promise growth and innovation. Let’s dive into the regions that are making big waves in the investment world.

Rising Stars In Asia

Asia’s economic landscape is dynamic and diverse. Key players are showing impressive growth rates. Look out for these rising stars:

- Vietnam: A robust manufacturing sector drives its economy.

- India: Tech and service industries are booming here.

- Philippines: A young workforce powers its growth.

Latin America’s Potential

Latin America is rich with potential. Its markets are ripe for investment. Key countries to watch include:

| Country | Industry |

|---|---|

| Brazil | Agriculture and energy |

| Chile | Mining and finance |

| Mexico | Manufacturing and digital services |

Frontier Markets Gaining Attention

Frontier markets are smaller but they hold big potential. They offer high growth possibilities. Keep an eye on these countries:

- Nigeria: Its entertainment and tech sectors are thriving.

- Vietnam: Again on the list, with its strong export economy.

- Bangladesh: Textile exports are driving its economy.

Developed Markets With Consistent Returns

When picking stocks, smart investors love developed markets. These markets are stable and profitable. They often bring good returns. Let’s look at some of the best places to invest in 2024.

North American Markets: A Safe Bet?

Investors trust North American markets. The US and Canada are known for their economic strength. Stocks here are usually a secure choice. They offer growth and are less risky.

- Dow Jones: Famous and reliable.

- S&P 500: Diverse with top companies.

- TSX: Canada’s leader, rich in resources.

European Markets: Recovery And Resilience

Europe’s markets are bouncing back. They’ve shown they can handle tough times. These markets offer a mix of old industries and new tech. This blend can be a smart investment in 2024.

| Market | Features |

|---|---|

| FTSE 100 | UK’s biggest, diverse sectors |

| DAX | German precision, top engineers |

| CAC 40 | French luxury, strong brands |

Pacific Powerhouses: Australia And New Zealand

Australia and New Zealand are growing fast. Their markets offer unique opportunities. They are rich in natural resources. Their banks are solid. These countries can be great for your 2024 portfolio.

- ASX: High tech and resources.

- NZX: Small but mighty.

Technology-driven Stock Markets

As we approach 2024, tech-driven stock markets are booming. Investors seek growth. Tech companies offer this. Smart investments can lead to significant returns. Knowing the right markets is key.

The Silicon Valley Effect

Silicon Valley remains a powerhouse. Its influence shapes global tech markets. Stocks here often lead in innovation. They provide substantial growth potential. Investors eye these stocks for portfolio success.

Asian Tech Hubs To Consider

Asia’s tech hubs are rising stars. Cities like Shenzhen and Bangalore are noteworthy. They host many high-potential startups. These markets promise exciting investment opportunities.

- Shenzhen: China’s tech capital

- Bangalore: India’s Silicon Valley

- Seoul: Leading in electronics and innovation

Innovation Centers In Europe

Europe has its own innovation hubs. Stockholm and Berlin stand out. They are home to vibrant tech scenes. These markets offer diverse investment options. They focus on sustainability and tech advancement.

| City | Focus Area |

|---|---|

| Stockholm | Fintech and Clean Tech |

| Berlin | Software and Biotech |

Sustainable And Green Investments

Sustainable and Green Investments are paving the way for a prosperous future. Smart investors eye the 2024 stock market with a green lens. They seek companies reducing carbon footprints and embracing eco-friendly practices. Let’s dive into sectors leading the charge.

Renewable Energy Market Growth

The renewable energy sector is soaring. Analysts predict a steep climb in demand for clean energy. Stocks in solar, wind, and hydro power are hot picks. The growth numbers speak volumes:

- Solar energy usage could jump by 15% annually.

- Wind power might see a 10% yearly increase.

- Hydropower projects continue to expand globally.

These stats make renewable energy stocks a top choice for 2024.

Green Technology And Its Stock Potential

Green technology is revolutionizing industries. Companies focusing on reducing emissions gain investor attention. Stocks in electric vehicles (EVs) and smart energy solutions are promising. Key players in green tech have the potential to outperform market averages.

Esg Criteria Shaping Investments

Environmental, Social, and Governance (ESG) criteria are reshaping investment strategies. Investors scrutinize company practices more than ever. Firms that score high on ESG metrics attract more capital. This shift ensures responsible investing with a focus on long-term sustainability.

| ESG Aspect | Investment Impact |

|---|---|

| Environmental | Higher preference for low carbon footprint companies |

| Social | Support for firms with strong community relations |

| Governance | Demand for transparent and ethical management |

Diversification Strategies For Global Investing

Investing globally in 2024 means spreading your money wide and wisely. Diversification strategies for global investing help investors mix different types of investments. This mix can lead to better returns and lower risks. Let’s explore how to balance, choose sectors, and manage risks for investing around the world.

Balancing Portfolios Across Regions

Putting your money in different parts of the world is smart. Different regions grow at different times. This can help your investments stay steady when some markets dip. Think of it like not putting all your eggs in one basket.

- North America: Tech and innovation lead here.

- Asia: Fast growth, with tech and manufacturing shining.

- Europe: Stable markets with a focus on green energy and finance.

Sector-based Diversification

Investing in different sectors is another smart move. Each sector reacts differently to economic changes. Mixing sectors can keep your portfolio strong, even if one sector falls.

| Sector | Why Invest |

|---|---|

| Technology | Drives innovation and growth. |

| Healthcare | Stays strong, even in tough times. |

| Energy | Essential and evolving with green trends. |

Risk Management In International Investing

Investing globally comes with its own risks. Currency changes and political shifts can affect your investments. But, there are ways to manage these risks and keep your money safe.

- Research: Know the countries and sectors you’re investing in.

- Diversify: Spread your investments to reduce risks.

- Stay Informed: Keep up with global news that might affect your investments.

Credit: www.tipranks.com

Potential Risks And How To Mitigate Them

Investing in the stock market in 2024 comes with risks. Knowing these risks and how to handle them is key. This section dives into potential risks. We’ll explore how to stay safe while aiming for good returns.

Political Instability And Its Impact

Political instability can shake markets. Elections, policies, and conflicts can affect stocks. To mitigate these risks, diversify your portfolio. Spread your investments across various sectors and countries. This approach helps balance out any downturns caused by political unrest.

Currency Risks In Global Investing

Investing globally exposes you to currency risks. When the value of foreign currencies falls, so does your investment return. To manage this, consider currency-hedged investments. These can protect you from harmful currency movements. Also, keep a portion of your portfolio in your home currency.

The Role Of International Relations In Stock Markets

International relations greatly influence the stock market. Positive relations can boost markets, while tensions can harm them. Stay informed about global events. Use this knowledge to make informed decisions. Diversifying globally can also help. It ensures you’re not too reliant on one market’s success.

- Stay informed: Follow global news closely.

- Diversify: Spread investments across countries and sectors.

- Use currency-hedged investments: Protect against currency risk.

- Monitor closely: Keep an eye on international relations and political events.

Expert Predictions For 2024

As we edge closer to 2024, the stock market buzz is palpable. Every investor’s dream is to hit the jackpot with the right stock picks. Experts are weighing in, and their predictions highlight a blend of strategy, insight, and intuition. Let’s dive into the top stock market picks from analysts, emerging trends, and the investment horizons that could shape your portfolio in 2024.

Analysts’ Top Stock Market Picks

Analysts’ Top Stock Market Picks

Analysts have their eyes on a few key players for 2024. These include tech giants, renewable energy leaders, and healthcare innovators. Here’s a quick look at the stocks making the top of the list:

- Tech Sector: AI and cloud services lead the way.

- Renewable Energy: Solar and wind companies are in the spotlight.

- Healthcare: Biotech firms with groundbreaking treatments stand out.

Emerging Trends to Factor In

Emerging Trends To Factor In

Staying ahead means keeping an eye on trends. In 2024, these are the areas to watch:

| Trend | Impact |

|---|---|

| Remote Work | Boost for collaboration and security tech stocks. |

| Eco-friendly Products | Growth in sustainable company shares. |

| AI Integration | Upsurge in AI-driven company valuations. |

Long-term vs. Short-term Investment Horizons

Long-term Vs. Short-term Investment Horizons

Your goals decide your horizon. Here’s a simple breakdown:

- Long-term: Focus on stable growth stocks.

- Short-term: Look for quick gains with volatile shares.

Remember, diversify to balance risks and rewards. Choose wisely between long-term holds and short-term trades.

Credit: www.motilaloswal.com

Tips For Investors Entering The 2024 Market

As 2024 approaches, the stock market beckons to new investors. Entering this financial terrain requires strategy and insight. This guide provides essential tips for navigating the investment landscape with confidence.

Research And Due Diligence Essentials

Knowledge is power in stock market investments. Start with these steps:

- Analyze historical performance of stocks.

- Study market trends and economic indicators.

- Read company financial reports and earnings statements.

- Keep abreast of industry news and global events.

The Importance Of Financial Advisors

A trusted financial advisor can guide your investment journey. They offer:

| Benefits | Details |

|---|---|

| Expertise | Market knowledge and investment strategies |

| Personalized planning | Customized portfolio to fit your goals |

| Risk management | Advice on how to balance risk and reward |

Leveraging Technology In Stock Market Investments

Embrace innovative tools to enhance your investment process:

- Use investment apps for real-time data and analysis.

- Implement robo-advisors for automated portfolio management.

- Explore AI-driven insights for predictive market analysis.

- Engage in online forums for investor communities and discussions.

Conclusion: Making Informed Decisions

Smart investment choices define financial success. Knowledge empowers investors. The 2024 stock market offers diverse opportunities. Decisions require careful analysis and strategy.

Recap Of Top 2024 Stock Markets

Investors witnessed strong performances in select markets. Key players stood out. Emerging markets showed promise. Technology and healthcare sectors dominated. Sustainability trends influenced market movements.

- Technology stocks soared with innovation.

- Healthcare shares benefited from medical advances.

- Emerging markets offered growth potential.

- Green investments gained traction.

Final Thoughts On Maximizing Returns

Maximizing returns involves strategy. Diversification reduces risk. Long-term investments often yield rewards. Timing the market proves challenging. Investors should focus on fundamentals.

| Strategy | Benefits |

|---|---|

| Diversification | Spreads risk across assets |

| Long-term focus | Compounds growth over time |

| Research-driven | Identifies solid fundamentals |

Investors should monitor market trends. They must evaluate economic indicators. Staying informed aids decision-making. Always consider risk tolerance. Personal goals guide investment choices.

Frequently Asked Questions

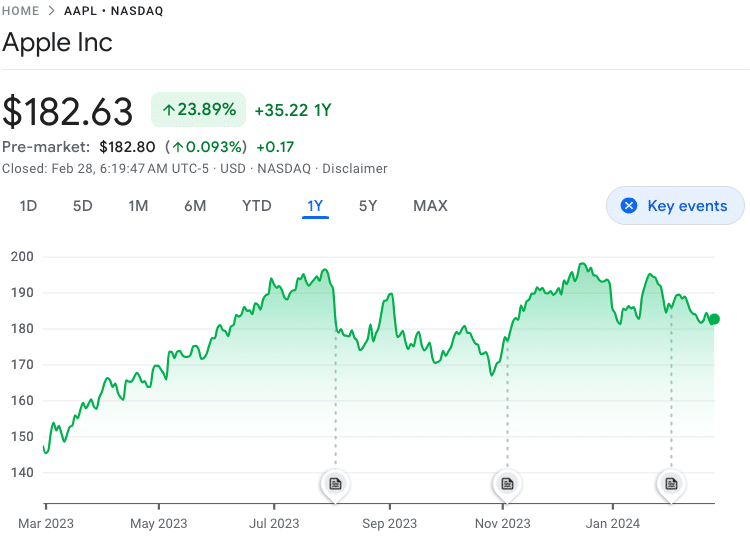

What Are The Top Stock Markets For 2024?

Investing trends suggest NASDAQ and NYSE remain promising for tech and diverse portfolios in 2024.

How To Start Investing In Stocks In 2024?

Begin by researching, setting a budget, choosing a reputable online broker, and diversifying your investments.

What Risks Come With Stock Market Investments?

Market volatility, economic changes, and company performance can significantly impact investment value.

Why Diversify Your Stock Portfolio In 2024?

Diversification reduces risk by spreading investments across various sectors, enhancing potential returns.

Are Tech Stocks A Good Investment In 2024?

Tech stocks, with their potential for innovation and growth, continue to offer attractive investment opportunities.

Conclusion

Navigating the stock market landscape in 2024 requires insight and foresight. The markets we’ve explored offer robust potential for savvy investors. Remember, diversifying your portfolio and doing thorough research are key to investing success. As we move forward, keep an eye on emerging trends and economic indicators to make informed decisions for your financial growth.

Choose wisely and invest confidently.