To invest in the stock market, open a brokerage account and fund it to buy stocks. Research and select companies or funds to diversify your portfolio.

Embarking on stock market investments requires strategy and knowledge. Start by educating yourself about the financial markets and the types of stocks available. This includes understanding the risks and potential rewards associated with stock investments. Ensure you have a solid grasp of your investment goals and risk tolerance, which will guide your decision-making process.

A thoughtful approach to stock market investing involves setting up a brokerage account, which acts as your access point to buy and sell stocks. Opt for a reputable broker that aligns with your investment style and provides valuable tools and resources. It’s essential to perform due diligence on potential stock picks or consider index funds for broader market exposure. Consistent monitoring and reassessment of your portfolio will help you make informed decisions, aiming to grow your wealth over time. Remember, investing in the stock market is not a guaranteed success, so invest only what you can afford to lose.

Table of Contents

Entering The Stock Market

Investing in stocks can be a thrilling journey. It is a path to potential wealth. Yet, it requires strategy and care. New investors must learn the basics first. The stock market is vast and full of options. This can seem overwhelming. But, with the right knowledge, you can navigate it successfully. Let’s explore how to assess your risk tolerance and set financial goals before you dive in.

Assessing Risk Tolerance

Understanding your risk tolerance is vital. It shapes your investment strategy. Some people sleep well with high-risk stocks. Others prefer safer bets. Knowing where you stand helps you pick the right stocks.

- High risk: Potential for great rewards, but more ups and downs.

- Low risk: Smaller returns, but more stability.

Consider using online quizzes or tools to gauge your risk level. These can guide your stock choices.

Setting Financial Goals

Clear financial goals steer your investment journey. They can be short-term or long-term. Examples include:

| Goal Type | Description | Time Frame |

|---|---|---|

| Short-term | Emergency fund, vacation | Less than 3 years |

| Long-term | Retirement, education | More than 3 years |

Decide on your goals. Write them down. Use them to choose stocks that align with your aims.

Research Fundamentals

Before diving into the stock market, smart investors do their homework. Researching fundamentals is key to success. This groundwork helps you understand companies and market movements. Let’s break down the essentials.

Understanding Company Financials

Company financials tell the story of its health. They are like a report card for businesses. Here’s what to look for:

- Balance Sheet: Shows assets, liabilities, and equity.

- Income Statement: Reveals revenue, expenses, and profit.

- Cash Flow Statement: Tracks cash in and out.

Look for growth trends in these documents. Consistent growth often means a strong company. Also, compare the company’s financials with its peers. This comparison can reveal strengths or weaknesses.

Analyzing Market Trends

Stock prices move with market trends. Identifying these trends is crucial. Use these methods:

- Study historical price movements.

- Observe volume changes.

- Follow news that affects stock sectors.

Remember, trends can guide your investment decisions. But they do not guarantee success. Always combine trend analysis with solid financial research.

Investment Options

Exploring investment options in the stock market can be exciting. Different choices offer unique benefits and risks. Understanding each option helps investors make informed decisions. Let’s dive into some popular investment avenues.

Stocks And Bonds

Stocks let you own a piece of a company. As the company grows, so does your investment. Bonds, on the other hand, are like loans. You lend money to a company or government. In return, they pay you back with interest.

- Stocks: Potential for high returns

- Bonds: Offer more stability and regular income

Mutual Funds And Etfs

Mutual funds pool money from many investors to buy a variety of stocks or bonds. ETFs, or Exchange-Traded Funds, are similar but trade like a stock on an exchange.

| Investment Type | Key Feature |

|---|---|

| Mutual Funds | Professionally managed |

| ETFs | Lower fees and flexible trading |

Both options provide diversification, which is key to reducing risk.

Credit: www.quora.com

Strategic Diversification

Strategic Diversification is key in stock market investment. It reduces risk. It can boost returns. Smart investors spread their money. They choose different stocks and sectors. This way, they stay safe when markets change.

Creating A Balanced Portfolio

A balanced portfolio is crucial. It has stocks, bonds, and other assets. These should vary in risk. Some are safe. Others are more daring. This mix helps protect your money.

- Stocks: They offer growth. They can be risky.

- Bonds: These provide steady income. They are less risky.

- Other Assets: Include real estate or commodities. They add variety.

Managing Sector Exposure

Sector exposure needs attention. Too much in one sector is risky. A good mix is better. Here’s how to manage it:

Add more rows as needed

| Sector | Percentage |

|---|---|

| Technology | 20% |

| Healthcare | 15% |

| Financials | 15% |

| Consumer Goods | 10% |

| Energy | 10% |

Adjust these numbers based on your goals. Keep an eye on market trends. Update your portfolio as needed.

Timing The Market

Let’s dive into the world of stock market timing. It’s like catching the perfect wave. Some say it’s luck, others call it skill. But one thing’s for sure – timing is everything.

Pros And Cons

Pros: Timing the market can lead to big wins. Buy low, sell high. That’s the dream, right? If you nail the timing, your rewards might be huge.

Cons: But here’s the catch – it’s tough to predict. Markets are tricky. They can move fast and leave you behind. Plus, timing wrong can mean big losses.

Long-term Vs Short-term Strategies

Long-Term: This is the marathon. It’s about steady growth over years. You invest, sit tight, and let time do its thing. It’s less about timing, more about patience.

Short-Term: This one’s the sprint. It’s quick, fast. You jump in, make trades, and hope for quick gains. It’s all about sharp moves and timing the market just right.

| Strategy | Risk Level | Potential Gain | Time Investment |

|---|---|---|---|

| Long-Term | Lower | Steady | Years |

| Short-Term | Higher | Variable | Days to Months |

Credit: www.fool.com

Risk Management

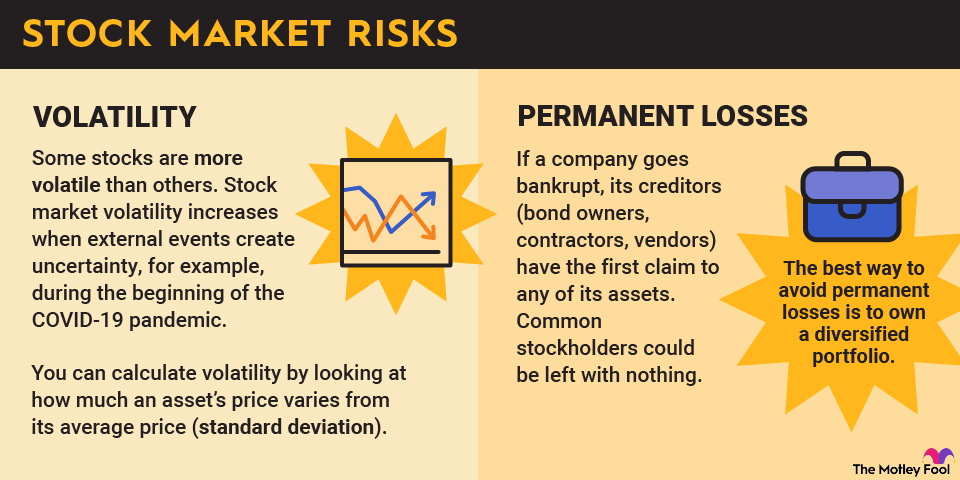

Investing in stocks can be exciting. Risk management is key to success. It helps protect money. Smart strategies are a must. They keep investments safer. Let’s explore two important tools.

Stop-loss Orders

Stop-loss orders are like safety nets. They sell stocks at a set price. This stops big losses. It’s like setting a floor. If the stock drops, the order activates. Selling happens automatically. This limits the loss.

Position Sizing

Position sizing controls investment size. It balances the portfolio. Not all stocks should be equal. Some are riskier. Some are safer. Position sizing spreads the risk. It keeps one loss from hurting too much.

Here’s a quick summary:

- Stop-loss orders can prevent big losses.

- Position sizing helps manage investment amounts.

Leveraging Technology

In the world of stock market investment, technology plays a big role. It opens doors to new strategies and tools. Now, let’s dive into how technology can help you invest smarter.

Using Investment Apps

Investment apps are a game-changer. They make investing easy and accessible. Here’s why you should consider them:

- Convenience: Buy and sell stocks from anywhere.

- Low Fees: Most apps have lower fees than traditional brokers.

- Educational Resources: Learn as you invest with built-in tools.

Popular apps include Robinhood, Acorns, and ETRADE. Each has unique features.

Algorithmic Trading

Algorithmic trading uses computers to trade stocks. It’s fast and efficient. Here’s how it helps:

- Speed: Computers execute trades in milliseconds.

- Accuracy: Reduces the chance of human error.

- Strategy Testing: Test strategies before risking real money.

To start, you might need some programming knowledge. Or, you can use platforms that offer pre-built algorithms.

Continual Learning

The journey into the stock market demands continual learning. Success here doesn’t just happen. It grows from regular updates and deep understanding. In this fast-paced world, staying ahead with knowledge is key. Let’s dive into how you can keep learning and growing.

Following Financial News

Staying updated is crucial. Financial news gives you insights. It shows what’s happening around the world. This affects stocks big time. Here’s how to stay informed:

- Read daily newspapers focused on economics.

- Watch news channels with financial segments.

- Follow online platforms for real-time updates.

These steps help you grasp market trends. You learn about company performances. Knowing these can guide your investment choices.

Educational Resources For Investors

Learning doesn’t stop. For investors, many resources are available. They range from books to online courses. Here are some ways to learn more:

- Read books by successful investors.

- Enroll in online courses about stock market basics.

- Join forums where investors share experiences.

These resources provide deep insights. They cover strategies and analyses. Understanding these can improve your investment decisions.

Credit: www.amazon.com

Frequently Asked Questions

How Do I Start Investing In Stocks?

Start by researching and choosing a stock brokerage or trading platform, then open an account, fund it, and begin buying stocks.

What Is The Minimum Amount To Invest In Stocks?

There is no official minimum, but some brokers require a minimum account balance, which can start as low as $0 to $500.

Are Stocks A Good Investment For Beginners?

Yes, stocks can be a good investment, offering potential growth over time, but beginners should educate themselves and possibly start with less risky investments.

How Do I Choose Stocks To Invest In?

Look for companies with strong financial health, good leadership, and growth potential. Consider diversifying your portfolio across different sectors.

Can I Lose Money In The Stock Market?

Yes, investing in the stock market carries risks, and it’s possible to lose money if stock values decrease. Always invest wisely.

Conclusion

Embarking on stock market investments can be transformative with the right strategy. Remember, knowledge is power; equip yourself with financial education. Diversify your portfolio to manage risk effectively. Patience and discipline are your allies in nurturing potential gains. Start small, dream big, and invest wisely for your financial future.